Tax Avoidance 'Morally Wrong' - New Poll

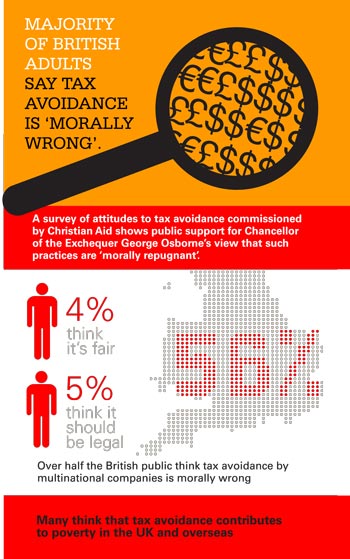

More than half British adults (56 per cent) believe that tax avoidance by multinational companies, while a technically legal way of reducing what they owe the taxman, is morally wrong

Half think it should be made illegal, while only four per cent of those polled thought tax avoidance by multinational companies was 'morally justifiable' and only four per cent described such practices as 'fair'. The ComRes poll found that many believe tax avoidance contributes to poverty in the UK and overseas. The survey of attitudes to tax avoidance was commissioned by Christian Aid, marking the launch of a Tax Justice bus tour at greenbelt this week. The development charity said it shows public support for Chancellor of the Exchequer George Osborne's view that such practices are 'morally repugnant'.

However many of the 2,026 people questioned in the survey by ComRes don't think these strong words are being matched with Government action.

For instance three quarters (74 per cent) felt that David Cameron should be demanding international action to tackle tax evasion and avoidance, yet just two in five respondents to the survey (38 per cent) believe the Government is genuine in their desire to combat tax avoidance.

More than half those asked (55 per cent) believe that the British government should make helping developing countries combat tax avoidance a greater priority than it is at present.

Joseph Stead, Senior Economic Justice Advisor at Christian Aid, said, 'This poll shows there is a huge public appetite for international action to tackle tax dodging both domestically and in developing countries.

'The public are clear that the government is not acting sufficiently, and that companies need to open their books more.'

The Tax Justice bus tour of the UK and Ireland launches on 24 August at Greenbelt, organised by both Christian Aid and Church Action on Poverty, to highlight the damage that tax abuse causes in countries rich and poor alike.

Christian Aid research estimates tax dodging by some unscrupulous multinational companies costs developing countries at least $160 billion a year, far more than the total global aid budget - money which could go on health and education. Church Action on Poverty says tax dodging in the UK deprives the government of funds to support vital services.

The bus will be making over 100 stops from Falmouth to Inverness and Dover to Belfast from 24 August through to 15 October. Politicians, church leaders and thousands of campaigners and members of the public will be invited to step aboard and show their support for an end to tax dodging.

A number of UK churches have thrown their support behind the Tax Justice Bus, with the Revd Jonathan Edwards, general secretary of the Baptist Union of Great Britain urging Christians to pray that tax dodging would be addressed. 'I am very grateful for the way in which Christian Aid doesn't shy away from tough messages,' he said.

'The Tax Justice Bus is a brilliant way of getting across the hard-hitting message that tax dodging harms the lives of millions of the most vulnerable people in the world.

'I hope that this initiative will help to raise the profile of this important issue and I trust that everyone will pray that the campaign will succeed.'

The charities want people to 'Tick for tax Justice' by signing a petition that calls on the Prime Minister to push for measures that would require:

-

Companies to report on the profits they make and taxes they pay in every country in which they operate.

-

Tax havens to share automatically information about the money flowing through them with other countries.

To find out more about the Tax Justice Bus tour follow us on Twitter @taxbus2012